Are you still cooperating with customers to make a low value commercial invoice?

Many exporters think it is human nature for customers to ask for low value commercial invoices to evade taxes. It is okay to help and cooperate to strengthen the cooperative relationship without affecting their foreign exchange collection and tax refund. That was before; now, there is a stake. Read on, and I’ll explain why later.

Table of Contents

What is a low value commercial invoice?

Making low value commercial invoices refers to the behavior of foreign trade operators in foreign trade that the value of customs clearance invoices provided to importers is lower than the real value of invoices provided when export declarations are made.

Simply put, the value of the import and export invoices is different, the export is normal, and the company also provides the import invoice, but the amount is lower.

Exporters are asked to assist in providing lower-value invoices, generally to help importers avoid import duties.

What are the risks of a low value commercial invoice?

(1) Enterprise breaks the law

Low value commercial invoices face great legal risks, and failure to catch them does not mean nothing will happen.

In 2006, the Ministry of Commerce of the People’s Republic of China promulgated the “Interim Measures for Punishment of Underwriting Export Invoices” (from now on referred to as the “Interim Measures”).

The “Interim Measures” stipulates in detail the punishment measures for low invoicing:

- Give warnings to companies that violate the law for the first time;

- For enterprises that violate again within two years after the first warning, in addition to being given a warning, a fine of up to RMB 30,000 may be imposed concurrently;

- Suppose the above-mentioned illegal acts seriously affect the order of foreign trade operations. In that case, the violating enterprise may be punished by prohibiting it from engaging in foreign trade operations within more than one year but less than three years, depending on the circumstances.

- For the legal representative of the enterprise that bears the main responsibility, depending on the circumstances, it is prohibited to serve as the legal representative of the foreign trade enterprise within more than one year and less than three years.

(2) Trade Risk is High

Note that “the laws of any country do not protect black and white contracts” with inconsistent import and export invoices.

When the goods arrive at the port, if the importer has a bad reputation, claims the right to the goods with a low-priced invoice, and conspires with the freight forwarder to claim the balance payment. At this time, the exporter assists the importer in tax evasion first, and the demand for recovery of the balance payment will be difficult to obtain local laws to support.

Theoretically, every low value commercial invoice has such a risk because the customer has the right to apply to the local court to adjudicate the right of goods according to the amount of his invoice.

Even if we finally find a lawyer to file a lawsuit to get back the rights to the goods and then arrange to return the goods to customs, the time, energy, and cost it takes are not a small price.

(3) Blacklisted by the Importing Country

In general, import invoices are electronically archived at customs.

Once the customs of the two countries launch the EDE (Electronic Customs Declaration and Clearance) system, the exporter will be included in the blocklist of the importing country’s customs as an accomplice of tax evasion.

Such as reputation damage is not conducive to the long-term development of enterprises in the country’s market.

(4) Damage to the overall interests of the industry

Foreign markets won by flexible means may have to be paid back.

Low value commercial invoices will not only affect the goodwill of Chinese manufacturing but will also become a “bomb” that may be detonated by the importing country at any time.

There are too many examples where the entire industry was subjected to anti-dumping investigations due to low invoices. Finally, the entire industry was levied huge anti-dumping duties by the importing country.

In the process of foreign trade, if most enterprises in an industry do not invoice lower prices for importers in principle, the interests of the entire industry will be lost in the end, and Chinese enterprises will suffer in the anti-dumping lawsuit.

Which customers prefer low value commercial invoices?

Customers from developing countries like Pakistan, Indonesia, Bangladesh, etc.

In most developing countries, the manufacturing industry system is imperfect, the economy is not developed enough, the legal system is imperfect, and the government is highly dependent on tax revenue. The higher the tariff, the more incentive for importers to evade taxes.

Because of these countries’ extremely high import tariffs, importers are lucrative in taking the risk. Therefore, they usually take chances and ask exporters to invoice at a lower price to cooperate with customs clearance.

Developed countries such as Europe, the United States, Japan, and South Korea have sound legal systems, and citizens are more aware of paying taxes and value credit. They generally don’t like tax evasion and even despise tax evasion.

In which countries are low value commercial invoices guaranteed to be caught?

If a foreign trader encounters an Indian customer who asks for a low value commercial invoice, he must never agree.

If the Indian customer insists on making a low value commercial invoice, then, on the one hand, sign a written agreement with the customer, and the customer bears all risks and responsibilities; on the other hand, ship the goods after getting the full payment. Otherwise, don’t cooperate.

Because the Indian Customs’ determination of the value of the goods is not based on the customs declaration invoice but on the value of the goods in their minds, yes, they all have steelyards in their hearts. Once they feel that the importer is evading taxes, the invoice will be lowered, and even if the customs declaration is honest, the goods will be withheld first.

In addition, China has exchanged customs data with some countries to combat low-price customs declarations.

One of the main indicators for customs development in the “14th Five-Year Plan” is: by 2025, the number of countries (regions) that are expected to be interconnected with overseas “single windows” will reach 15.

What is "Single Window Interconnection"?

On the one hand, this cooperation will help improve the efficiency of customs clearance and enhance the credibility of trade data; on the other hand, it will help the customs of both sides to accurately crack down on illegal declarations such as under-declaring the value of goods through data audit and comparison when supervising and enforcing the law.

For example, before China and Pakistan exchanged customs electronic data, many importers in Pakistan reported the price of imported goods at a price lower than the invoice to achieve the purpose of tax evasion. At the same time, China’s export declaration was based on the actual price of the goods Report truthfully.

After the electronic data exchange, the discrepancy between the two will be completely transparent. The customs clearance amount declared by the local Pakistani importer must be consistent with the export amount declared by the Chinese exporter to the Chinese Customs to complete the customs clearance successfully. Otherwise, the local importer in Pakistan will be fined!

China Belt and Road Web Link:

| Chile | Philippines |

| Indonesia | Korea |

| Kyrgyzstan | Singapore |

| Pakistan | Georgia |

| Kazakhstan | Russia |

| Belarus | Switzerland |

| Armenia | New Zealand |

| Kongkong China | Taiwan China |

The customs of the above countries pay close attention to the electronic data transmitted by China.

If the customer is from the above countries, relevant information can be shared with the customer for reference. Be sure to unify the amount of import and export invoices and declare them in compliance.

Since the customer is unfamiliar with China’s export policy, we remind the customer that this is an illegal act in China. Once checked, the customer may not be able to receive the goods, and the goods will be detained and fined, a loss for both sides.

Customers generally don’t insist on a low value commercial invoice. It is easier to accept if it is rejected on policy grounds and analyzed from the customer’s perspective.

Cases for making low value commercial invoices

Case One

In July 2014, Brazil decided to conduct an anti-dumping investigation on ballpoint pens originating in my country. In this case, the average price of my country’s ballpoint pens exported to Brazil is 4 cents per pen. In comparison, the customs declaration price of Brazil’s customs statistics is only 1.5 cents, and the price difference is as high as 2.5 cents, while Brazil’s price definition for anti-dumping is 2.6 cents.

Case Two

In January 2015, India filed an anti-dumping lawsuit against my country’s silk products. The trigger for this lawsuit was that Chinese export companies falsely issued low-priced invoices at the request of importers. The Chamber of Commerce for Import and Export of Textiles has often put forward opinions.

To sum up, the low value commercial invoices issued by export companies are harmful and not beneficial. Enterprises should consciously abide by laws and regulations, uphold business ethics, refuse to provide low value commercial invoices to importers, and actively maintain market order. This is also one of the ways for companies to protect their legitimate interests from infringement. Only when companies maintain a consistent attitude of rejection can they maintain a good and safe foreign trade environment. In addition, the country should also strengthen legal construction, improve regulations, increase punishment for this behavior, and standardize industry behavior.

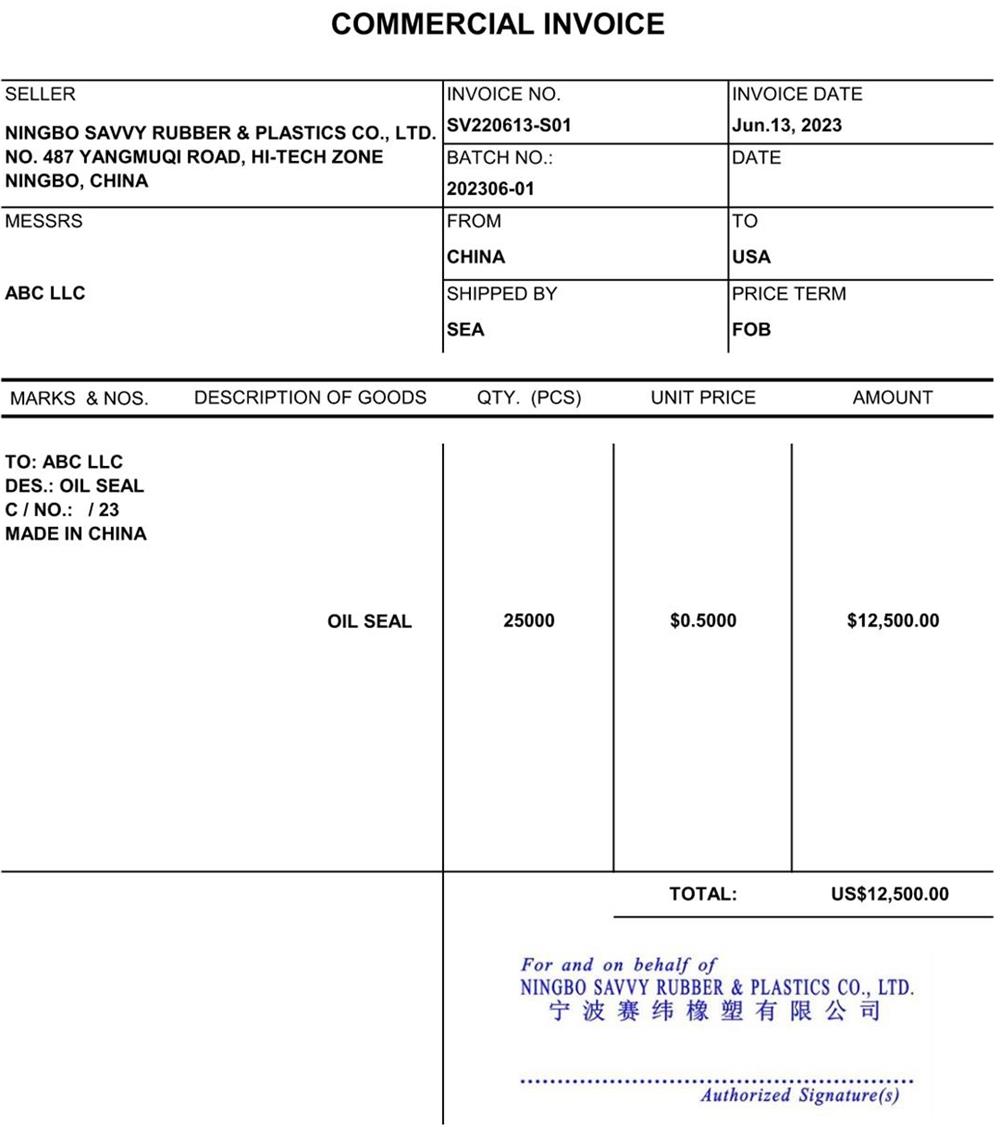

What is a real value commercial invoice like?

We never suggest you make a low value commercial invoice, but always use the real-priced commercial invoice. For your reference, please refer to the following good commercial invoice template from Savvy Rubber.

To know more about import-export knowledge, please read our blog: https://savvyrubber.com/blog/